AAX

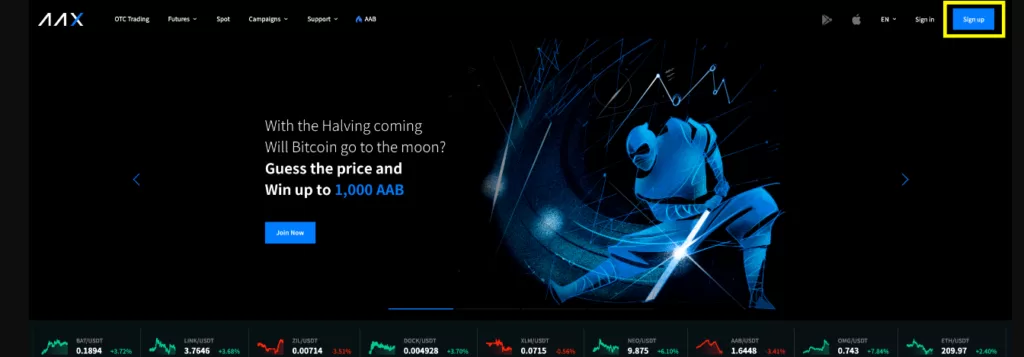

It is not easy to find a safe and reliable cryptocurrency exchange to purchase and sell virtual currencies. You need to choose a highly regulated platform that ensures the best security standards and works with fiat currencies. AAX is one of the cryptocurrency exchanges with these integrated features. You can enjoy high-speed transactions on this platform.

Founded in 2018 and launched in 2019, AAX is a reputed cryptocurrency exchange designed to attract retail trading professionals to increase blockchain technology adoption. It has advanced digital services and products, including futures contract exchange, interest accounts, and the crypto spot market.

A team of crypto professionals runs the platform, Atom Asset Exchange (AAX). The fintech company, ATOM International Technology Ltd has developed the platform. AAX is the only crypto platform backed up by a financial information and stock exchange agency.

Thor Chan, a prominent IT specialist, is the CEO of AAX. Registered in Malta, the AAX cryptocurrency exchange saves your effort, as you do not need to undergo passport verification to withdraw up to 2BTC a day. Read the review of AAX and make your decision on signing up with the site.

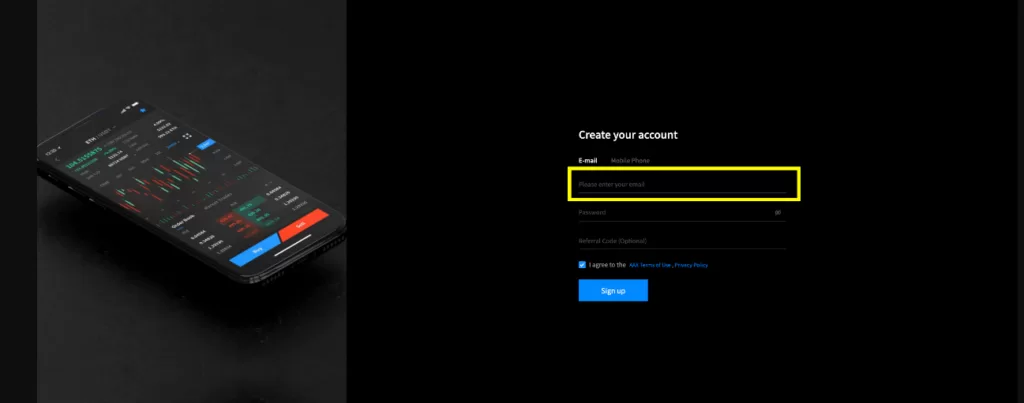

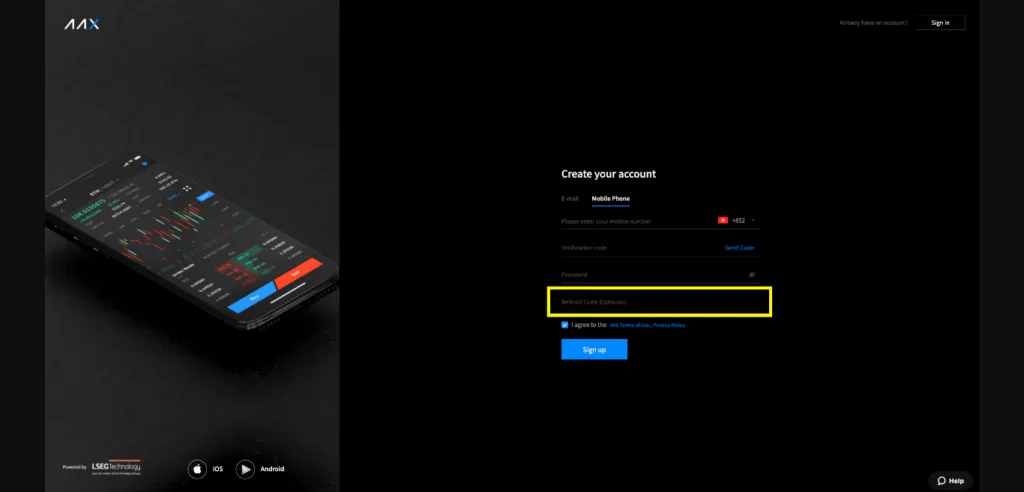

It is easy to register with AAX for crypto trading.

You just need to visit the website https://www.aax.com and click on the blue Sign Up button

Next, you have to navigate to the registration page and read the given instructions. You have to add your phone number, email address, and a strong password. to get started.

Then, choose the Send Code option after submitting your mobile number. You will next get an SMS with the confirmation code. Enter the verification code and create login credentials.

There is also a space for referral codes for those who have been invited by some other users.

Click on the button- Sign Up, and the process is over. Once you are done with these processes, your account is created. This process is not different for app users.

When signing up for AAX please enter EjVZOcnQmzXl as the referral code. You simply just use the link from our website and you are good to go.

Let’s now have a look at some amazing features:

LSEG technology

AAX is different from other cryptocurrency platforms due to its LSEG technology. The innovative technology helps you in processing 60 to 100 thousand transactions every second, and the latency rate is very low.

AAB is the deflationary token native to AAX. AAX users have a chance to enjoy promotions and attractive rewards. Every week, you can find the AAB Flash Sale at AAX. However, this discount is a time-limited offer, and almost 1000 users can buy AAB tokens at the discounted rate. You may also get free AAB tokens. But, make sure that you have undergone the Level 1 verification process.

When you have finished different activities at the Reward Hub, you will receive 45 AAB tokens. Moreover, you may try to invite friends to the platform to get special rewards.

At the AAX exchange, you can engage in spot trading 50 market pairs. The best trading pairs available for you include BTC/USDT, ETH/USDT, AAB/USDT, and LINK/USDT. Liquidity and daily activity can make a difference in these pairs.

It is an over-the-counter trading solution, especially for those who are involved in high-volume trading activities. OTC is useful when you trade in high volumes. You can avoid slippage in this trading process.

There is an option for directly trading BTC, USDT, and AAB tokens. You need to go through KYC Level 1 verification to use this feature.

AAX has some automated trading partners, like Stacked and Quadency. Professional and intermediate-level cryptocurrency users will get advantages from them. These automated platforms enable you to trade in crypto assets across more than one exchange while using one dashboard. You can check your orders easily from the platform.

You can create a crypto assets savings account without any lockup period. It helps in earning your income from a passive source. You can find 6 to 8% APY for savings. Level 1 users will get access to their savings account. You may transfer your assets to your savings account. You will start earning from the day of creating the account. Thus, save your currencies in AAX and take advantage of it.

The AAX team always tries to maintain integrity and security, and that’s why it ensures high-level protection to your assets. Your digital assets remain stored in multi-sig, cold wallets. Moreover, the company has partnered with a risk consulting agency, Kroll.

AAX offers highly scalable crypto exchange solutions at a global level. But, there are several countries where citizens cannot access the AAX platform. AAX has also taken steps against money-laundering activities. It has teamed up with a software agency (Solidius Labs) to control market manipulation.

You do not need KYC documentation to create your AAX trading account. Thus, you can avoid submitting a copy of your driver’s license, passport, and any other document. It may be due to the fact that Malta’s regulations are not strict.

You may access some AAX features without KYC. However, with verification, you can use the platform in a better way. There are 3 levels of the verification process.

AAX has presented you with a highly transparent fee structure. You can check out withdrawal and trading fees before signing up with the platforms. AAX Spot trading fee is very low compared to other exchanges. However, you can reduce it by increasing your trading volume. Moreover, AAB tokens are useful for paying your trading fees.

Another important thing to note is the Futures Trading fees. Whatever be your trading pair, you can find no difference in Futures Trading fees. By using your AAB tokens, you can decrease the fees. Furthermore, AAX has provided you with detailed information about minimum withdrawal limits for different types of cryptocurrencies it supports. Internal transfers and deposits do not need additional charges.

The most important thing for traders is the maker-taker fee. At AAX, the taker fee is about 0.10%. It is lower than the standard rate, as most other companies charge about 0.10%. Makers, trading at 0.06%, can enjoy the trading fee discounts. The special model for maker-taker fees helps with liquidity.

You can deal with more than 40 cryptocurrencies at the AAX cryptocurrency exchange. The long list includes Ethereum, Bitcoin, and several other digital currencies. Moreover, you can use Defi tokens, like CRV, YFI, UMC, and UNI.

You can choose any currency for your Spot Trading activities. But, 5 of them are intended for AAX’s Futures market, and they include ETH, BTC, BCH, COMP, and LINK.

AAX has established its offices in different countries in the Asia Pacific region. Users from Thailand, China, New Zealand, Malaysia, Singapore, Taiwan, and Australia can use its platform. But, there are some jurisdictions where AAX is not available.

Cryptocurrency is the only acceptable option for your deposits. That is why new investors do not find it easy to do trading at AAX. As a new cryptocurrency investor, you need to buy cryptos from other platforms.

You may also buy cryptocurrency on this platform using your credit card, debit card, and bank transfer. You have a chance of purchasing up to 300$USD of cryptos without using KYC.

One demerit is that you cannot withdraw fiat currency at the AAX cryptocurrency exchange. It is because of the imposed regulations related to fiat withdrawals.

You can easily withdraw your BTC from your AAX account. You need to pay 0004 BTC for withdrawing Bitcoin. Thus, the crypto trading platform has set consumer-friendly fees for withdrawal.

You can download a responsive and intuitive mobile app for AAX trading in the crypto markets. The app is downloadable on both Android and iOS devices. You can access almost every feature from the app. Invest in cryptocurrencies using your mobile.

Pros

Cons

A new platform- No strong evidence about the reliability

During the month of September, AAX is running a promotion where participants who successfully buy at least 100 USD worth of crypto in a single order will receive a random reward or treasure box key. If you collect 5 keys you will get a mysterious prize. Prizes include 0.5 BTC, Macbook pro, up to 200 AAB, and more.

AAX exchange provides you with attractive features to help in better trading activities. The rapidly developing platform has started growing the trust of several investors. The security protocols, matching engine, and trading options can attract you. You can create your account to trade in cryptocurrency.

| Founded | 2018 |

|---|---|

| Official website | https://www.aax.com/ |

| Supported currencies | 60+ |

| Customer support URL | https://aax.zendesk.com/hc/en-us |

KYC is not required to crate a trading account. In order to use all the features on the exchange KYC is necessary.